I originally wrote a version of this post on stockopedia.co.uk

but thought worth re-jigging it on here to incorporate some further research

and thoughts into one place.

Avanti (AVN.L) is a communications company operating

satellites providing internet capacity to users who don’t have access to

regular high speed internet capacity via broadband. Currently they have 4

operational satellites (ARTEMIS, HYLAS 1, HYLAS 2, HYLAS 2-B) with plans to

launch 2 more in 2017 (HYLAS 3 & HYLAS 4).

Launching satellites is a capital intensive

business. You spend hundreds of millions of dollars getting them into space

with the expectation that they pay for themselves many times over in their c.15

year useful lifetime. The capital intensity combined with the long payback

period makes Avanti a high risk investment. If the geographic areas they

covered were to receive broadband access of high speed mobile internet then the

demand for their services would decline rapidly or face severe pricing

pressures. The investment case for Avanti very much depends on how rapidly they

can sell their satellite capacity while retaining premium pricing. Any analysis

of the company should focus on these factors.

They have been heavily loss making so far but

promise rapid growth that will deliver profitability to the company in the

future:

‘…management expects

cash generation to grow swiftly as revenues exceed Avanti's largely fixed cost

base.’ Q1 2016 Trading Statement

In order to judge their success we need to

look at what are their sources of revenue. These are my understanding of the

main categories of Avanti’s sales in order of declining quality:

- Data sales – these are really what Avanti is about selling internet data - they should be high margin and cash received under normal payment terms.

- Equipment sales – Avanti also provide the equipment for users to access their data services. Usually these will be paid in cash, again good quality but variable in nature.

- Project sales - where they are paid to do work for a client, good quality but usually non-recurring.

- Equipment sales where they are paid over a number of years - presumably they are intended to allow cash strapped customers to generate data sales they couldn't otherwise however these are particularly poor quality earnings since the revenue is booked in year 1 with the cash coming in much later and the risk of bad debt (of which they have had some.) Also since they are lending the money to the customers at about half of their cost of debt capital the longer the terms the worse the deal as Matthew Earl points out here: http://lordshipstrading.blogspot.co.uk/2014/11/avanti-avn-questionable-quality-of-sales.html

- Spectrum sales - as far as I can tell these seem to be completely non-cash since there is no up-front payment to them and no accrual in the balance sheet. As Tom Winnifrith points out rather than generating cash for Avanti this ‘sale’ is costing them $13m cash over the next few years: http://www.shareprophets.com/views/16999/avanti-communications-a-letter-to-the-financial-reporting-council-re-2015-accounts . These sales are of such poor quality that it seems Winnifrith has written to the FRC to question it.

It would be great to be able to separate out

the revenue and costs associated with data sales and equipment sales and

analyse these separately but as far as I can tell Avanti have not provided

these consistently. In the 2014 Annual Report they do break revenue out into $16.6m

of equipment sales out of $65.6m total. They did the same in 2013 but in the

2015 Annual Report they only break out the $25.1m Spectrum ‘sales’. Also you

have to read the notes to the Annual Reports to see these. They don’t seem to

be broken out in the half year results or in the results RNS’s. Hence the analysis

that follows excludes the non-cash sales of Spectrum Rights but assumes all

other revenue is recurring.

Things were going well for Avanti until H1

2015 when revenue started to drop. (H1 2016 is estimated by doubling Q1 2016

revenue.)

This sort of drop off in revenue can mean one of two

things. Either customers are using less of £AVN ’s services, or they are

paying less for them.

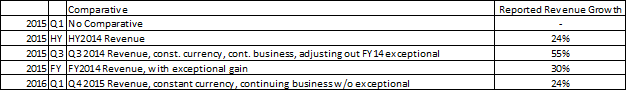

Not that you’d be able to see this revenue drop if you

read Avanti’s management commentary. By careful choice of comparatives, last

quarter vs same quarter in the previous year, and including exceptionals in the

reporting period and excluding them in the comparative period they have managed

to give the appearance of rapid revenue growth in a period when revenue has

been dropping half on half:

Let’s look at some of the comments relating to utilization

and pricing:

‘Average Fleet Utilisation was at the upper end of the

20% to 25% range during the period’ Q1 2016 Trading Statement

‘Avanti's average pricing remained stable.’ Q1

2016 Trading Statement

‘This was lower than Avanti's prevailing run rate of

growth, due to a larger amount of equipment and government revenue in the previous

year, which, although recurring, tends to be recognised on a non-linear basis.’ Q1 2016

Trading Statement

‘Avanti's Fleet Utilisation was within the 20% to 25%

band at the end of 2015, having increased from the 10% to 15% range in the

prior year.’ 2015 FY Results

Based

on these comments I’ve added estimate of the utilisation to the revenue graph:

So it seems that data rates are stable but customers

are paying less for £AVN’s equipment or value added services meaning that

rapidly increasing utilisation is not turning into increasing revenue.

So if we are conservative

and assume that Q1 2016 had very little equipment sales and was mostly data

revenue what is interesting is to scale up the Q1 2016 revenue to get the

maximum theoretical revenue at full utilisation as

Avanti suggest we do in their 2015 annual report:

If

we take 23% as ‘the upper end of the 20% to 25% range’ then based on the Q1

2016 revenue of $13.6m at the current pricing the maximum theoretical revenue

of the existing satellites is $238m a year.

So

how fixed are those costs? The accounts split costs into 3 categories:

1. ‘Satellite

Depreciation’ we will ignore for now as a non-cash cost.

2. Operating

Expenses do appear to be largely fixed costs running at

$35m pa for the last couple of years. If anything these will increase slightly

as Avanti state ‘There will be a modest increase in costs in 2016 as further

investments are made in sales and marketing and ground operations ahead of

the launches of HYLAS 3 and HYLAS 4.’ Annual Report 2015

3. Cost of

Sales however do not appear to be fixed as an absolute

value but as a percentage of revenue of c.60%. I had expected the gross margin

to increase as data sales made up a greater proportion of revenue however there

is little sign of this in the numbers. Given that COS as a % of revenue are

around 60% when revenue is $7m or $40m then it would seem a reasonable figure

to take for COS as a percentage of $238m revenue = $143m.

So at full utilisation the current

satellites will generate OCF of $238m – $143m – $35m = $60m.

However Avanti has c.$640m of debt accruing interest

at 10%pa = $64m/year interest which means even at full utilisation the current

satellites would generate a cash loss of $4m/year. Given these sums it is

somewhat surprising that the Avanti share price reacted positively to the Q1

2016 results, although it has since fallen back to below previous levels.

Avanti

have $219m of cash on hand so can manage an extended period of high negative cash

flow however the majority of that cash is committed to the

development and launch costs of HYLAS 3 & 4. This means that although I

don’t think the committed cash should be included in a valuation it is also

wrong to exclude the future potential revenue from HYLAS 3 & 4 when they

are launched in 2017.

In order to work out what the impact of the valuation

implied by the $13.7m Q1 revenue and 'upper end of the 20% to 25%

range’ for utilisation we need an NPV. To do this we always need to

make some assumptions, here are mine:

1. As

previously stated Avanti don’t consistently break out data revenue and

equipment revenue so I have to assume that these move roughly in

step.

2. Maximum

Revenue is assumed to be proportional to capacity in GHz with ARTEMIS,

HYLAS 1 & HYLAS 2 adding up to the $238m current max revenue at full

utilisation. The revenue capacity of HYLAS 2-B, HYLAS 3 & HYLAS 4 are

proportional to their capacity.

3. Avanti

depreciate satellites over 15 years which is meant to be there useful life.

Therefore I assume they generate no revenue 16 years after launch. This looks

like:

4. Cost of

Sales remain at 60% of revenue. Admin Expenses at $35m pa and debt interest at

$64m pa.

5. Utilisation

increases 10% each year to reach full utilisation at 100%.

An NPV is only as good as its assumptions of course

but with these (that could be considered aggressive in some areas e.g. 10%

discount factor when the debt is yielding 10%, they are funding with debt &

equity and equity holders are taking more risk) yields an NPV10 of only

$480m – considerably less than the outstanding debt:

With

the current 182p share price you have a market cap of c.$400m and an EV post

capex of c$1.0b vs a $480m valuation.

Of course this analysis ignores revenue from any future

satellites Avanti may

develop & launch. The reason is that these would have to be funded via

further debt and/or equity. In lieu of this I have excluded satellite

depreciation. With these assumptions Avanti would be FCF positive in

2019 however not earnings positive until 2021 or later with

depreciation charged to the income statement. Note that the senior secured

notes are due in 2019. Since Avanti will not be able to repay these from cash flow

they will be reliant on credit markets at the time to refinance this debt.

Assuming

they can increase the utilisation more rapidly at 20% pa to reach full capacity

then the NPV10 increases to c$840m. More than the debt but still makes the

equity significantly overvalued. Add in an extended life of each the satellites

for 5 years at full capacity in addition to the rapid utilisation and you still

get an NPV10 at a discount to current EV.

In conclusion, unless Avanti can rapidly increase

capacity utilisation much faster than they have done in the past or if they can

generate significantly higher pricing & margins then the equity could

well be worthless. That Avanti’s management seems to prefer finding creative ways

of giving the appearance of growth in their commentary rather than actually driving

the business to create this growth, gives me little confidence that they will

deliver improved growth or margins in the future.

Disclosure:

Since the current equity valuation seems to be pricing highly optimistic

scenarios for both pricing and utilisation that I believe to be unrealistic

based on the performance of the company over the past 2 years I am currently short

the equity.

Just a heads up that I'm now completely out of my short position on this.

ReplyDeleteIt pretty much played out as expected although things came to a head earlier than I thought cash flow wise which is nice. The high debt interest combined with the failure of management to raise enough money to see them through to cash flow break even or control costs caught up with them in the end and no amount of gloss on the results or accounting gimmicks could prevent that.

With a sale of some point on the cards the risk is probably now to the upside. As a separate entity and without a highly dilutive placing I think their liabilities exceed their assets. But a larger player who have a much lower cost of capital could make a case for paying something for the equity. I still think the smart play could be to pick up the space assets from the administrator and bin the failed management but that has risks in itself.

The upside isn't clear enough for me to go long but enough to close out my short.